Gecko Homes Shared Ownership Approach

No matter how you choose to buy your home whether outright or through a government-backed scheme like Shared Ownership, we know that it is one of the most exciting times of your life, but one that also comes with stressful moments. We’re here to support you every step of the way, so if you have any questions or need more information, please don’t hesitate to reach out to us.

As part of the journey to owning your own home, you must have read and accepted our Shared Ownership Key Information and Policies early on. Our team will guide you through the buying journey and help with any questions you have at any stage, but before we can reserve your dream home, we need to make sure you can comfortably afford to buy your home.

At Gecko Homes, we believe in providing a fair and considerate approach when assessing your application to buy from us. We do this to make sure you can comfortably afford to manage mortgage and rent payments.

To make sure we’re being fair, we have a First Come, First Served policy for allocating Shared Ownership homes that we sell at Gecko Homes.

This means that the person or people who complete the relevant checks first are the ones who get to buy the homes. We think this is fair to everyone and gives people a reasonable chance of buying a home.

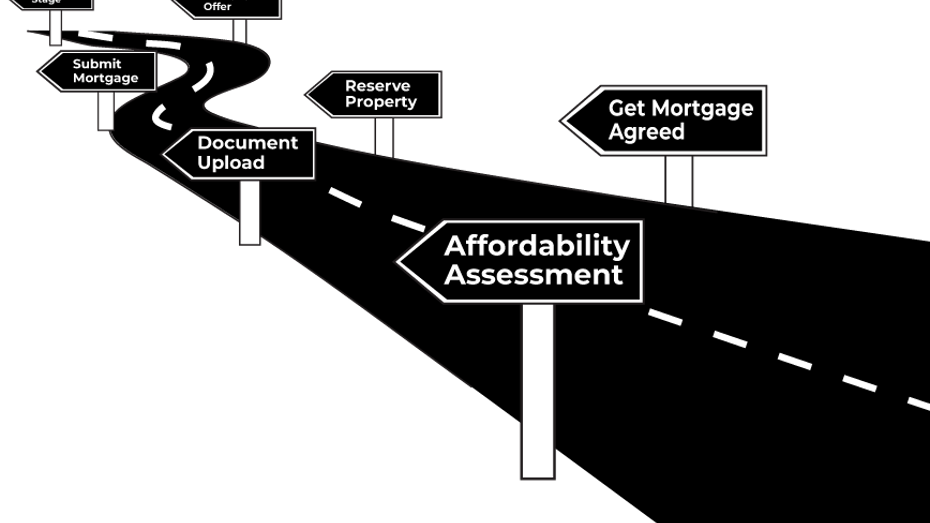

How this works:

- You must have passed an initial financial assessment. Until you have, we can’t put your name on a home because there’s still some uncertainty about whether you can go ahead with the sale. The first people to pass this check are the ones able to put their name down on a new Shared Ownership home

- The affordability assessment is carried out on our behalf by Metro Finance, a regulated and qualified mortgage advisor

- Once you’ve passed the initial assessment you have five working days to provide all the documents needed and a valid Agreement in Principle to get full sign-off from the mortgage or financial advisor

- The allocation process is done in order of the customers who have completed the assessment and provided all the documents needed by the advisor

- Then when you’re allocated a home, you have to complete the reservation paperwork and pay a plot deposit to make the home yours

To be able to buy a Shared Ownership home from us at Gecko Homes, you will need to be able to pay at least a 5% deposit of the share value that you can afford to buy. The deposit will need to be from your own resources and you will need to be able to provide evidence of the source of these funds when asked by our mortgage advisors.

We've partnered with the friendly team at Metro Finance who are one of the leading mortgage advisors in the UK and are fully regulated to complete financial assessments on our behalf. They will also help you find a suitable mortgage lender should you need one.

While we look at your credit history, we understand that sometimes life throws curveballs that can affect your financial situation. If you've experienced credit challenges, we encourage you to share any exceptional circumstances and supporting evidence. We'll thoughtfully review this information to determine if it helps to offset any concerns.

However, if you're currently dealing with bankruptcy, an IVA, or a debt relief order, we won't be able to offer you a home. This is because these situations typically involve outstanding debts to multiple creditors, and it’s important to prioritise settling these obligations. Using extra funds for a deposit instead of addressing these debts might increase your risk of financial complications.

- No CCJ’s or Defaults that remain unsatisfied within the last 2 years unless there are clear communication defaults

- No CCJs or defaults within last 2 years, satisfied or unsatisfied over £300

- No unsatisfied CCJs or defaults of more than £1000, registered at any time

- IVAs or Bankruptcy discharged 3 years ago acceptable, or registered over 6 years ago and satisfied, with no further issues

- Debt management plans that have been repaid are acceptable

- No mortgage arrears in last 12 months

- Previous repossession over 3 years ago acceptable, provided no outstanding debt to lender and no other credit issue in last 3 years (requires letter from repo lender to confirm no outstanding debt)

Typically, most buyers will get a mortgage. We want you to feel confident in choosing the mortgage lender that best suits your needs. While we don’t dictate which lender you should use, we do aim to ensure that your mortgage arrangements are both affordable and sustainable for you.

We understand that mortgage interest rates and deals can vary based on individual circumstances and deposit sizes. Sometimes, this means that you may only qualify for mortgages with interest rates higher than the average for Shared Ownership. This can happen for a variety of reasons, such as employment situations or credit history. Even if you meet the affordability and sustainability criteria, starting with a higher mortgage rate can make you more vulnerable to future changes in base rates, which might pose additional risks for both you and Gecko Homes.

To help protect you, we pay special attention if your mortgage rate is 2% above the average rate for similar mortgages from five major Shared Ownership lenders (like Leeds Building Society, Halifax, Nationwide, Santander, and Barclays). In such cases, we might require a higher remaining net income on the budget planner and will carefully review the overall situation to decide if we can move forward.

We appreciate your understanding and are here to support you in any way we can. If you have any questions or need further clarification, please don’t hesitate to reach out to us.

Most Shared Ownership buyers will purchase using a mortgage from an approved lender, but cash buyers are also accepted. You will still need to complete a financial assessment with Metro Finance if you are a cash buyer looking to secure a Shared Ownership home from us.

-

Present valid credit files, irrespective of the reason. This includes partners/spouses of applicants who must also meet the adverse policy

-

The reason for needing to be a cash buyer cannot be because you are unable to obtain a mortgage due to adverse credit from a non-high interest rate lender

-

If due to your age, our assessment will need to consider future income changes if you are still currently working as this may change imminently

-

Your income must be considered sustainable

-

Your outgoings must be realistic, ONS data for expenditure may be used in some instances

-

You will need to complete a budget planner. This must be based on household composition and include realistic figures for all expenditures, backed up by bank statements where necessary. If you are buying less than a 25% share you will need a minimum of 20% net income remaining over

Read our guide

Buying your first home is definitely one of the most exciting times of your life, but one that also comes with stressful moments. Our comprehensive guide is ready to download and read so that you can understand everything you need to about Shared Ownership.

We’re here to support you every step of the way, so if you have any questions or need more information, please don’t hesitate to reach out to us.

Download Guide